What is Time Series Data?

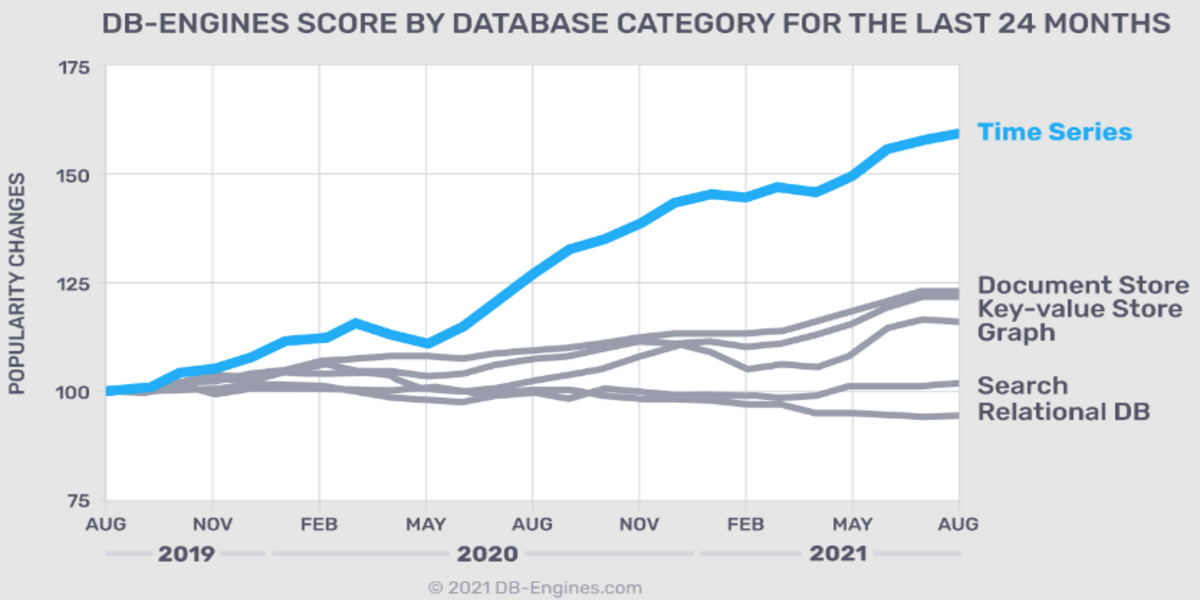

Time-series data refers to a series of data points that are ordered in time. It introduces an order dependence between a set of observations. Time series are ubiquitous in today’s data-driven world. As every event follows the arrow of time, we are in constant interaction with a variety of time-series data. Time series are generally assumed to be generated at regular intervals of time and are referred to as regular time series. However, the data within that time series need not be generated at regular intervals. Such instances encompass irregular time series where data follows a temporally phased sequence. This implies measurements might not occur at regular intervals. However, data might be generated at discrete time intervals or as a burst. ATM withdrawals or account deposits are examples of irregular time series. Technically, in a time series, one or more variables change over a given time period. If a single variable varies over time, it is termed as Univariate time series. For example, consider a sensor measuring the temperature of a room every second. Here, only a one-dimensional temperature value is generated at every instant (i.e., second). On the contrary, when more than one variable changes over time, it is called a Multivariate time series. For example, consider bank economics. In such cases, multivariate time series are used to comprehend how policy changes to one variable, such as repo rate, may affect other variables (i.e., loan disbursement for commercial banks). Time series data finds its application in every discipline, from finance, geology, meteorology, manufacturing to computing, IoT, physical and social sciences. It is used to track weather changes, birth rate, mortality rate, market fluctuations, network performance, and many other applications. Some of its main use-cases include monitoring, forecasting, and anomaly detection. For example, time-series forecasting plays a critical role in determining the popularity of database management systems. The figure below shows the growing popularity of DBMS over the years (2019-2021) in a time series plot.

Key Components of Time Series

The factors that influence the values of an observation in a time series are treated as their key components. The three categories of components include:

Trend

The tendency of data to increase or decrease over a long period of time is referred to as a trend or a long-term component. However, it is important to note that the upward or downward movement need not necessarily be in the same direction over a given time span. The tendencies can either rise, fall, or remain stable over different sections of time. The overall trend, however, must always equate to an upward, downward, or stable pattern. Such movement tendencies are evident in the examples such as agricultural productivity, death rate, devices manufactured, number of factories, etc. Linear and Non-Linear Trend Plotting time series values against time on a graph reveals the type of trend based on the pattern of data clustering. If the data cluster is more or less around a straight line, then the trend is termed as a linear trend. Otherwise, the data cluster pattern shows a non-linear trend as the ratio of change between two variables is not stable or constant. Hence, such trends are also called curvilinear correlations.

Short-term Movements

In a time series, these components tend to repeat themselves over a period of time. They have irregular short bursts and affect the variables under study. The two category types under short-term movement include: Seasonal Variations These versions operate regularly and periodically over a period of less than a year. They tend to have a similar or almost the same pattern during a 12 month period. Such variations become a part of a time series if the data is recorded regularly, i.e., hourly, daily, weekly, monthly, or quarterly. Seasonal variations are either man-made or naturally occurring. Different seasons or climatic conditions play a critical role in such variations. For example, crop production relies entirely on seasons. Similarly, the market for an umbrella or raincoat depends on the rainy season, while the sale of coolers and A.C. units peaks during the summer season. Man-made conventions include festivals, parties, and occasions like marriages. Such short-term events recur year after year. Cyclic Variations Time series variations that tend to operate over a period of more than a year are referred to as cyclic variations. For a business, one complete period is regarded as the “Business Cycle”. The spike or decline in business performance depends on various factors such as economic structure, business management, and other interacting forces. These cyclic business variations may be regular but not periodic. Generally, businesses undergo a four-phased cyclical process comprising prosperity, recession, depression, and revival. Such cyclic variations are integral to a time series pattern as business development relies heavily on the generated “sequential data points”.

Random or Irregular Movements

Random components cause a significant variation in the variable under observation. These are purely irregular fluctuations without any set pattern. The forces are unforeseen, unpredictable, and erratic in nature—for example, earthquakes, floods, famines, and other disasters. Random events described above are analyzed using the source time-series data to tackle better such real-life scenarios that may occur in the future.

Types of Time Series

Time series data can be divided into four types, deterministic, non-deterministic, stationary, and non-stationary. Let’s take a look at each type in detail.

#1. Deterministic Time Series

A deterministic time series can be described with an analytic expression. It does not involve random or probabilistic aspects. Mathematically, it can be expressed exactly for all time intervals in terms of a Taylor series expansion. This is possible if all its derivatives are known at some arbitrary point in time. These derivatives explicitly specify the past and future at that time. If all the conditions are fulfilled, it is possible to accurately predict its future behavior and analyze how it behaved in the past.

#2. Non-deterministic Time Series

A non-deterministic time series has a random aspect associated with it which prevents its explicit description. Hence, analytic expressions aren’t feasible enough solutions to express such a time series. A time series may be non-deterministic due to the following reasons: Due to the random factor, the non-deterministic time series obeys probabilistic laws. Therefore, the data is addressed in statistical terms – implying data is defined by probability distributions and averages of various forms. This includes means and measures of dispersion, i.e., variances.

#3. Stationary Time Series

In a stationary time series, the statistical properties such as mean, variance, and others do not rely on the time aspect. A stationary time series is easier to predict as one can state with certainty that its statistical properties will stay the same as they have been observed in the past. Hence, various statistical forecasting methods are based on the argument that the time series is just about stationary. This implies that the times series can be regarded as stationary in approximation by applying simple mathematical transformations.

#4. Non-stationary Time Series

In a non-stationary series, the statistical properties vary with time. Hence, the time series with trends, or seasonality, fall under the non-stationary category as the trend and seasonality may affect the value of the time series at different time intervals. Non-stationary time series describes unpredictable data, preventing it from being modeled or forecasted.

Time Series Analysis and Forecasting

Time series analysis and forecasting are handy tools for observing, analyzing, and studying the evolution and dynamics of vital processes and objects of different kinds. Let’s look at each one in greater depth.

Time Series Analysis

Time series analysis is defined as a process of analyzing the data collected over a period of time. Here, data analysts record data in constant intervals over a fixed time period. The data observation rate, i.e., the time interval, can vary from seconds to years. Time series data describes variables under inspection as it provides a detailed analysis of the fluctuating pattern over a specific time span. The parameters necessary for analysis may vary across different domains and disciplines. Some of the examples may include:

Scientific instruments – Data recorded per day Commercial website – Customer visits per day Stock market – Share values per week Season – Rainy days per year

To ensure consistency and reliability, time series analysis operates on large quantities of data points. A good sample size is a subtle representation of the authenticity of a discovered trend or pattern. Additionally, time series analysis is also suited for predicting future events based on past recorded data.

Time Series Forecasting

Time series analysis allows organizations to identify the root cause of fluctuations in trends over time. With data in hand, enterprises can then study and research further to understand better how to tackle unfamiliar trends and forecast upcoming events. Companies generally employ data visualization techniques to determine such anomalies in data. Time series forecasting revolves around two essential factors: In forecasting, the primary objective is to essentially predict how the data points will continue to stay the same or vary in the future. Here are some examples from different industry sectors to better understand the nuances of times series analysis and forecasting.

Stock market – Forecasting the closing stock price each day. Sales – Predict product sales for a store each day. Pricing – Forecasting the average fuel price each day.

Some of the common statistical techniques used for time series forecasting include simple moving average (SMA), exponential smoothing (SES), autoregressive integrated moving average (ARIMA), and neural network (NN).

Time Series Data in the Cloud

To unveil the value of time series data, enterprises should be able to store and query data quickly. Capital market companies rely on large volumes of historical and streaming data to employ real-time data analytics and make impactful business decisions. This may involve predicting vulnerability at stock prices, determining net capital requirements, or forecasting exchange rates. To provide flexibility and process data seamlessly, many firms are opting for migration of their time-series databases to the cloud. With the migration of time series databases to clouds, organizations can gain access to unlimited resources on-demand. It allows firms to utilize hundreds of cores to accomplish their task that maximizes network throughput without latency issues. Time series databases in the cloud infrastructure are suitable for compute-intensive workloads. This includes performing risk calculations in response to real-time market trends. Financial firms can do away with the data center overhead and zero in on utilizing resources to improve the productivity of their workloads. Hence, cloud infrastructure amplifies and scales the benefits of time series data.

Applications of Time Series

Time series models serve two purposes, Let’s look at some of the application use cases of time series data.

#1. Time Series in Financial and Business Domain

All financial, business, and investment decisions are taken based on current market trends and demand forecasts. Time series data is used to explain, correlate and predict the dynamic financial market. Financial experts can examine the financial data to give forecasts for applications that help in risk mitigation, stabilize pricing and trading. Time series analysis plays a key role in financial analysis. It is used in interest rate prediction, forecasting the volatility in stock markets, and many more. The business stakeholders and policymakers can make informed decisions about manufacturing, purchases, resource allocation, and optimize their business operations. This analysis is effectively used in the investment sector to monitor the security rates and their fluctuations over time. The security price can also be observed for the short term (i.e., record data per hour or day) or the long term (i.e., observation stretched over months or years). Time series analysis is a useful tool to track how a security, asset, or economic variable performs over an extended period of time.

#2. Time Series in Medical Domain

Healthcare is rapidly emerging as a data-driven field. In addition to financial and business analysis, the medical domain is greatly leveraging time series analysis. Consider a scenario that requires a synergy of time series data, medically aligned procedures, and data mining techniques while treating cancer patients. Such a hybrid framework may be employed to harness feature extraction functionalities from the collected time-series data (i.e., patient’s x-ray images) to track the patient’s progress and response to treatments provided by the medical fraternity. In the healthcare sector, deriving inferences from the constantly changing time-series data is of critical value. Additionally, advanced medical practices demand that patient records be connected over time for better visibility of patient’s health. Also, the patient’s health parameters must be recorded precisely at regular intervals to have a clearer picture of the patient’s health status. With advanced medical instruments coming to the fore, time series analysis has established itself in the healthcare domain. Consider below examples,

ECGs devices: Devices invented for monitoring cardiac conditions by recording the electrical pulses of the heart. EEG devices: Devices used for quantifying electrical activity in the brain.

Such devices have allowed medical practitioners to exercise time series analysis for faster, effective, and accurate medical diagnosis. Additionally, with the advent of IoT devices such as wearable sensors, and portable healthcare devices, people can now take regular measurements of their health variables over time with minimal inputs. This leads to a consistent data collection of time-dependent medical data for both sick and healthy individuals.

#3. Time Series in Astronomy

Astronomy and astrophysics are the two modern disciplines where time-series data is being leveraged significantly. Fundamentally, astronomy involves plotting cosmic objects’ trajectories and celestial bodies and performing accurate measurements to better understand the universe beyond the earth’s atmosphere. Due to this requirement, astronomical experts are proficient in handling time series data while calibrating and configuring complex instruments and studying astronomical objects of interest. Time series data has long been associated with the field of astronomy. In 800 B.C., sunspot time series data were collected at regular intervals. Since then, time series analysis was used to

Discover faraway stars based on stellar distances, Observe cosmic events such as supernovae to comprehend the origin of our universe better.

Time series data, in this case, relates to the wavelengths and intensities of light given off by stars, celestial bodies, or objects. Astronomers constantly monitor such live streaming data to detect cosmic events in real-time as and when they occur. In recent times, research areas such as astroinformatics and astrostatistics have emerged, which blend various disciplines such as data mining, machine learning, computational intelligence, and statistics. In these novel research areas, the role of time series data is to detect and classify astronomical objects quickly and efficiently.

#4. Time Series in Forecasting Weather

Aristotle studied weather patterns extensively to comprehend better the causes and effects observed in weather changes in ancient times. As days progressed, scientists started recording weather-related data on instruments such as “barometer” to compute atmospheric variables. The data were collected in regular intervals and kept in different locations. With time, eventually, weather forecasts began featuring in newspapers. Fast forward to today’s day and age, ubiquitous weather forecasting stations are installed in different geographies around the world to collect accurate weather variables. Such stations have advanced functional devices that are interconnected to gather and correlate weather data from various locations. The correlated data is used to forecast weather conditions at every time instance depending on requirements.

#5. Time Series in Business Development

Time series data enables businesses to make business decisions. This is achieved as the process analyzes past data to derive future events and throw light on probable possibilities. The past data pattern is used to derive the following parameters:

Business growth: To evaluate the overall financial and business performance and measure growth, time-series data is the most suitable and reliable asset.

Estimate trend: Various time series methods may be employed to estimate emerging trends. Consider, for example, these methods analyze data observations over a period of time to reflect on an increase or decrease of sales of a particular electronic device.

Unveil seasonal patterns: The recorded data points could reveal fluctuations and seasonal patterns that could aid in data forecasting. The obtained data information plays a key role for markets where product prices fluctuate seasonally. Such data may assist enterprises in better product planning and development.

Conclusion 👨🏫

In summary, time-series data can be viewed as the characteristics of complex data points collected over a constant period of time. Time series analysis, modeling, and forecasting have become an integral part of our everyday lives with the emergence of IoT gadgets, smart home appliances, and portable devices. Besides, time-series data is finding its application in diverse fields, including healthcare, astrophysics, economics, engineering, business, and many more.

![]()