The collapse of one of the significant centralized crypto exchanges, FTX, has created concern among traders and investors. People are thinking about alternatives to protect their cryptocurrencies. The FTX collapse caused by its founder Sam Bankman-Fried is not a rare incident in the crypto space. QuadrigaCX, which claimed to be Canada’s largest crypto exchange, filed for bankruptcy in 2019. QuadrigaCX’s failure was followed by its founder Gerald Cotten’s death in 2018. Apart from that, the customer’s crypto assets worth $120 million also got trapped. Netflix released a documentary, “Trust No One: The Hunt for the Crypto King,” based on the QuadrigaCX scam. Bitfront, a U.S.-based crypto exchange, also decided to shut down. The repeated problems have resulted in the acceptance of decentralized exchanges. For instance, Telegram plans to build its decentralized exchange following the FTX issue. First, let’s understand the decentralized exchange.

What is a Decentralized Exchange (DEX)?

Decentralized exchanges are decentralized applications (DApps) that allow you to buy and sell crypto assets without any middlemen. A direct transaction occurs between the buyer’s and seller’s digital wallets. Decentralized exchanges use smart contracts to exchange crypto assets between users. Moreover, these exchanges offer transparency for all crypto transactions. The trading process on DEX is also simple. You only need to visit the exchange, connect your wallet, and trade your tokens. As simple as that! There are different types of decentralized exchanges; the major ones are:

On-Chain Order Books: This order book type of DEX executes transactions using the blockchain, and it is considered the most transparent and decentralized process. Off-Chain Order Books: Unlike on-chain, this DEX uses a centralized authority to conduct transactions and govern the order book. DEX Aggregators: Here, the data from various DEXs is compiled to increase liquidity to buy and sell crypto assets. Automated Market Makers (AMM): These DEXs use smart contracts to create liquidity pools and execute automatic trades using algorithms.

Let’s have a look at why people prefer decentralized exchanges.

Advantages of Decentralized Exchanges Over Centralized Exchanges

The significant advantages of decentralized exchanges are:

#1. Privacy

If you want to use the features of a centralized exchange, it is mandatory to verify Know Your Customer (KYC). On the other hand, you can access a decentralized exchange without any user verification process. You can trade your cryptocurrency without providing any personal details. This privacy feature safeguards you from identity theft.

#2. No Counterparty Risk

Unlike centralized exchanges, decentralized exchanges don’t hold your funds. This feature also helps prevent misuse of your funds, which recently happened with the FTX exchange. Suppose you use centralized exchanges; you must deposit your funds on the exchange before trading. In this case, you are risking your funds with the exchange. In contrast, your assets are safe inside your crypto wallet if you use decentralized exchanges. You only need to connect your wallet with the exchange when buying or selling.

#3. Lower Security Risk

Hacking cryptocurrencies is one of the major risks associated with centralized exchanges. For instance, the hacking of Mt.Gox, Bitfinex, and Coincheck are famous examples of such hacks that involved cryptos worth millions of dollars. In the case of decentralized exchanges, your crypto assets are safely stored in your hot or cold wallet. Also, targeting an individual’s wallet is less feasible and profitable for hackers.

#4. Token Availability

Centralized exchanges only list a smaller number of crypto tokens. In addition, most such exchanges only support limited projects. Meanwhile, you can trade new tokens with the help of decentralized exchanges. Decentralized exchanges come in handy if you want to buy a token at an early stage. The top decentralized exchanges available are:

Uniswap

With over $3 billion in total value locked (TVL) of Ethereum, Uniswap is one of the largest decentralized exchanges. This DEX overtook Coinbase to become the second-largest Ethereum trading platform after Binance. Uniswap DEX works based on an automated market maker (AMM) powered by smart contracts. You can swap any of your ERC-20 assets using Uniswap while remaining anonymous. UNI is the native token of the Uniswap platform. You can use this token to obtain rewards and vote on governance proposals. Apart from token swaps, you can be a liquidity provider and receive rewards. Uniswap charges trading fees of 0.3%. Supported Networks: Ethereum, Optimism, Polygon, Celo, and Arbitrum. Supported Wallets: Coinbase Wallet, MetaMask, WalletConnect.

PancakeSwap

Built on the BNB Chain, PancakeSwap is a major decentralized exchange. You can use this DEX to swap any of your BEP-20 tokens. PancakeSwap has an average of nearly 2 million monthly users. Moreover, this DEX executes an average of 55 million monthly trades. PanecakeSwap also works on the AMM model using smart contracts. Apart from that, you can also benefit from the low trading fees. You need to pay a trading fee of 0.25% of the total translational value. In addition, you also need to pay for the network fees. CAKE is the native token of PancakeSwap with multiple use cases. You can use CAKE for staking, yield farming, and voting purposes. Supported Networks: BNB Smart Chain, Aptos, and Ethereum. Supported Wallets: MetaMask, Binance Wallet, Coinbase Wallet, Trust Wallet, WalletConnect, Opera Wallet, Brave Wallet, MathWallet, TokenPocket, SafePal, Coin98, and Blocto.

Curve

Curve is a DEX built on Ethereum. Founded by Russian scientist Michael Egorov, Curve also works based on the AMM model. If you plan to trade stablecoins, then you can consider Curve DEX. The efficient smart contract algorithm of Curve provides you with price stability. Along with the price stability, Curve DEX also restricts high price slippage. Apart from that, the fee is as low as 0.04% of the total transaction value. Apart from that, Curve provides a user-friendly platform for trading tokens. In addition, you can also choose a custom price slippage to avoid substantial price variations. Curve has its native token, CRV. You can use this token to pay fees or to receive staking rewards. Supported Networks: Ethereum, Avalanche, Arbitrum, Celo, Fantom, Gnosis, Kava, Optimism, Moonbeam, and Polygon. Supported Wallets: MetaMask, Ledger, Torus, Trezor, Coinbase Wallet, Formatic, Portis, and WalletConnect.

1inch

How about a decentralized exchange that helps you find cryptocurrencies at the lowest price? Sounds great, right? That’s what 1inch DEX does. 1inch aggregates other DEXs making it different from other decentralized exchanges as it. This DEX helps you choose the best market price for a cryptocurrency. On the positive side, 1inch doesn’t charge you to deposit, withdraw, or trade. You only need to pay the fee of the DEX you use to trade. You can use 1inch to trade any ERC-20 tokens. Moreover, 1inch provides high liquidity for the traded tokens. Supported Networks: Ethereum, Polygon, BNB Chain, Optimism, Avalanche, Gnosis, Fantom, Arbitrum, Aurora, and Klaytn. Supported Wallets: 1inch WalletConnect, Trust Wallet, MetaMask, Binance Chain Wallet, WalletConnect, Coinbase Wallet, Venly, Ledger, KeepKey, Trezor, Portis, CoolWallet, Fortmatic, MEW, Torus, and Bitski.

SushiSwap

SushiSwap is a DEX built on the Ethereum network and is considered an extension of UniSwap. Apart from trading tokens, SushiSwap allows you to farm, stake, and lend various crypto assets. SUSHI is the utility token of SushiSwap DEX. You can stake SUSHI to earn a part of the trading fees. SushiSwap charges a trading fee of 0.3%. Here, liquidity providers and SUSHI token holders receive 0.25% of the fee. Supported Networks: Ethereum, Polygon, Arbitrum One, Avalanche, Fantom, BSC, Gnosis, Moonriver, Arbitrum, Fuse, Celo, Moonbeam, OKXChain, Boba, and Harmony. Supported Wallets: MetaMask, WalletConnect, Gnosis Safe, and Coinbase Wallet.

Balancer

Balancer is an Ethereum-based DEX that helps you deposit or swap your ERC20 tokens. Apart from that, Balancer also provides arbitrage trading opportunities. BAL is the native token of Balancer. You will receive BAL tokens for every successful trade. Balancer has a strong liquidity pool with a TVL of more than $1.5 billion. Ethereum constitutes more than 90% of the available liquidity. Another feature of Balancer is its customizable pools with varying fees. The fee ranges from 0.0001% to 10%. Supported Networks: Ethereum, Polygon, and Arbitrum. Supported Wallets: MetaMask, WalletConnect, Tally, and Coinbase Wallet.

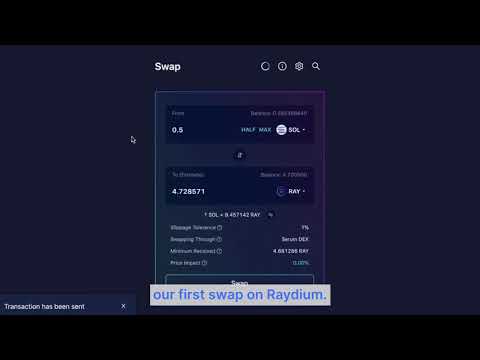

Raydium

Are you a fan of Solana? Then you should try Raydium, a Solana-based decentralized exchange. Raydium also provides a TradingView charting interface. This feature helps you analyze the price before trading tokens. RAY is the governance token of Raydium. The stake rewards are also distributed in RAY tokens. Raydium charges a fee of 0.25% on the traded value. In addition, you need to pay a minimal network fee in SOL. Supported Networks: Solana Supported Wallets: Phantom, Sollet, Ledger, Solflare, Torus, WalletConnect, and Brave.

Bancor

Bancor is a popular DEX built on Ethereum. This decentralized exchange provides simple and safe access to trade crypto tokens. You can use Bancor to conduct automated token trades. In addition, liquidity providers receive interest. Bancor Network Token (BNT) is Bancor’s native token. Therefore this token is used to reward liquidity providers. Trades executed on Bancor come with minimal network fees that vary according to the traded value. In addition, you also need to pay a gas fee. Supported Networks: Ethereum and EOS. Supported Wallets: MetaMask, WalletConnect, Ledger, Coinbase Wallet, Trezor, Gnosis Safe, Frame, Portis, Torus, and Fortmatic.

QuickSwap

Are you looking for a Polygon-based DEX? Then QuickSwap comes in handy. QuickSwap, built on Polygon, is a favorite among the DEXs. Its significant advantages are low fees and faster transaction times. QUICK is the governance token of QuickSwap. Also, a QUICK holder can participate in voting and create innovative proposals. QuickSwap charges a fee of 0.3% for every swap. Liquidity providers receive this fee. Supported Networks: Polygon Supported Wallets: Trust Wallet and MetaMask.

Final Words

There is a popular expression in the crypto world, “not your keys, not your coins .” Simply put, you only have total control of your crypto assets if it’s stored in your wallet. In the case of centralized exchanges, you are trusting your cryptos with a third party. As a result, these exchanges have total control over your assets. Instead, you can use decentralized exchanges to avoid fund misuse. Moreover, you can also enjoy other safety features. This article includes a list of the top decentralized exchanges. To summarize, you can choose a decentralized exchange based on your preferred network and wallet. You can also explore the best crypto-staking platforms.

![]()